Lessons from Category Disruptors

Eroding market shares, low profit margins & declining distributions in an increasingly fragmented & overcrowded marketplace. Daily conversations in the halls of most traditional CPG companies have transitioned from growing sales to retaining market shares, consolidating brands. The legacy brands in CPG companies are facing an uphill challenge from upstart brands. One that the brands’ strong equities have made impossible to overcome.

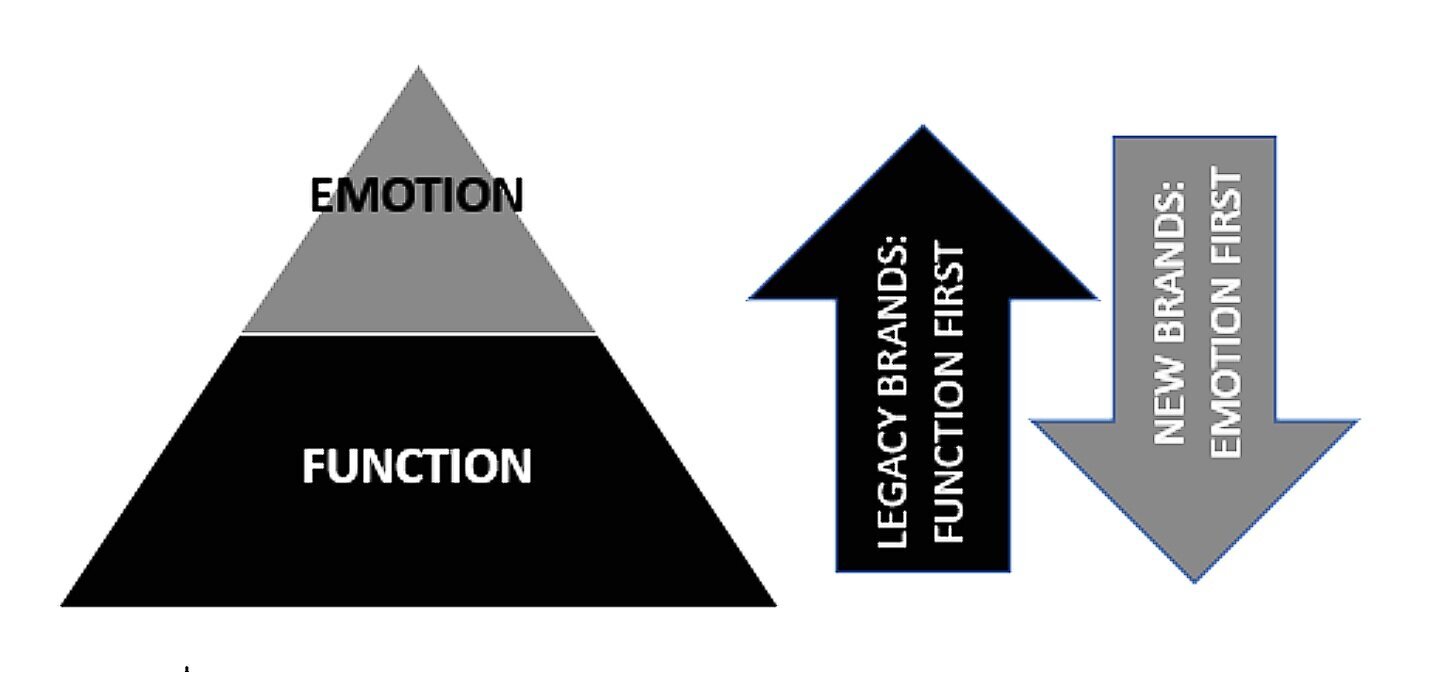

Think of the traditional consumer goods brands you have in your house. Now think why you own these products. More often than not, the answer would be that they are functional, effective & trusted.

Look around & you’ll see some newer brands, products that have crept into your household, especially when you think beauty & food products. Why are these your new choices? Is it because they make you ‘feel’ a certain way about yourself? Or maybe because they stand for a cause in which you believe.

When these legacy organizations were born, most of them 100+ years ago, consumers expected basic functions from their household products. A food item had to deliver on taste & nutrition, a cleaning product (surfaces or body) had to deliver on clean & fragrance. The needs were basic & so were the products designed around them. These brands appealed to the masses. And so began the journey of legacy brands – with stories built around function & marketing platforms around consumer benefits. Over the decades, these brand identities just kept getting stronger, entrenching these brands within these old perceptions, even when they tried to diversify themselves.

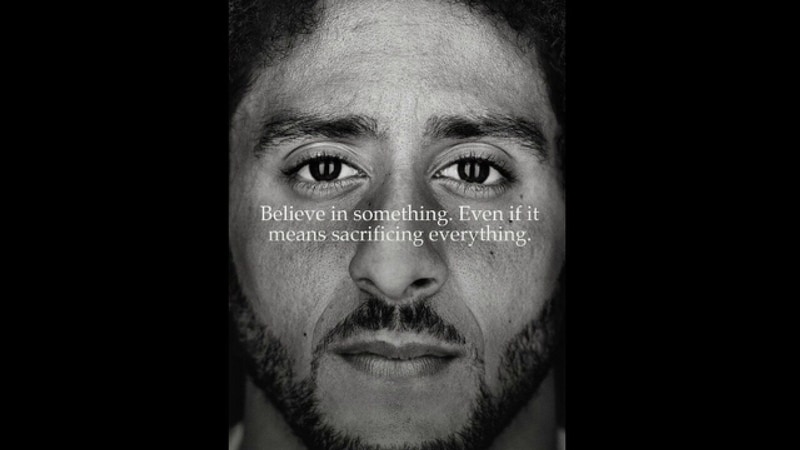

In a complete turn of events, the brands launching today find that they need to address the needs of a much more evolved consumer, one that has nuanced tastes & expects efficacy as a point of parity. These brands then identify an emotion or a purpose they want to evoke in the consumer. What then happens is something magical. The brand stands for something that is not a function. And then the product itself becomes secondary. Consumers then start connecting with the brands that mirror the emotions they value or causes for which they stand. These brands are intentional in not trying to appeal to the mass, they are looking for customers with curated tastes, something that others would aspire for, as the brand awareness starts to spread.

While legacy brands continue to justify their presence by volume, those very volumes continue to decline. Even when the brands try to reposition themselves, few do it successfully. One of the key reasons for this is that legacy brands are afraid to take a risk. A move that may alienate the most loyal of their consumers. Most brands find themselves unable to diversify into new categories for the same reasons.

There are lessons from the younger brands, that legacy organizations can take note of, and potentially implement, to breathe a new life into the life cycle of the brands.

- Agility. Brand teams are flat & given a fair amount of autonomy to ensure quick decisions & a better ability to pivot quickly.

- Courage. With a high risk, high return mentality, these brands are more open to taking risks, make bold moves. When a move doesn’t pay off, these brands are also able to be cutthroat and cut their losses.

- Purpose. Most of these brands are the Davids fighting for shares with limited budgets, against the bottomless Goliaths of legacy brands, and that gives them a drive that is unmatched by any comfortable large organization.

- Authenticity. These brands also make transparency & authenticity a big part of their brand identity, talking in a voice of a friend to the consumer, versus an adviser role that most legacy brands fill.

- Premium. While legacy brands try to premiumize, the journey becomes a lot more difficult if the consumers do not see the value being delivered with the increase in price. New brands enter the market with these added-value perceptions & find it much easier to charge a premium for their products. On a volume vs margin play, these brands are winning big time for this one reason.